0860 22 22 88

0860 22 22 88

[email protected]

[email protected]

Helpdesk hours: 8h00 to 16h00 Monday to Friday.

1 Adderley Street

Cape Town

Check your fund balance here: Register/Login

Employer Information

All employers in the tourism, hospitality and catering sector, or related industry that are acceptable to the Board of Trustees, can become a participating employer in the Thacsa Retirement Fund. No organisation is too big or small to become a participating employer once accepted by the Trustees.

- Comprehensive website with all documents downloadable.

- Online and mobile phone access for members to check and update personal information.

- Members are kept informed by regular sms.

- Employer web portal makes returns fast and easy, minimising paperwork.

- Thacsa provides market leading death and disability cover, medical underwriting only required if in the 45% tax bracket.

- Thacsa is unique, providing 6-month extended cover of death and funeral benefits on resignation, retrenchment, dismissal or retirement.

- Death benefit is 4x annual pensionable salary.

- Three month waiting period for disability benefit claims.

Fund Facts

Here is an easy reference guide for you to understand the benefits of the Thacsa Retirement Fund for you and your employees.

What is the process?

Complete the installation form and have your employees complete the new entrant form. These, together with the initial billing schedule, company registration documents, personal liability form and employer portal registration form must be submitted to [email protected]

The completed forms must be submitted to the Fund. On receipt the Fund will issue a certificate, confirming your participation in the Fund. You will be issued with a unique reference number (8269…./T….) that should be used in all correspondence with the administrator and when any payment is made to the Fund.

Administrative Processes

The administration process detailed below provides you with all the information you may require on contribution payments and submitting claims. This will assist you in fulfilling the fundamental role you play as a participating employer to the Fund. And remember, please do not hesitate to contact us if you have any questions or require our assistance.

Remember, the most efficient way to submit your monthly reconciliations is via the Employer Portal. This online tool greatly reduces the chance of error and minimises the time required to compete these mandatory tasks. If you are not already using the Employer Portal, please contact the Help Desk for assistance.

New Member Entry Form

Monthly reconciliation and payment of contributions

All schedules should be submitted electronically via e-mail to [email protected]. Please click here Monthly employer recon example Thacsa monthly employer recon example to view the format in which the schedule must be submitted.

Payment of contributions: Contributions are paid in arrears, by the 7th of the following month and are payable into the following Nedbank account:

Name: Thacsa Pension Fund

Account: 1051 613 922

Branch code: 14 54 05

Payment reference is your Fund Membership number

Queries regarding the reconciliation process must be emailed to [email protected]

Employer Portal

The preferred method of submitting monthly returns is through the employer portal. This is a state-of-the-art online system that links directly to the administrator. In addition to the monthly returns a number of other important administrative functionality exists. If you are not making use of the online portal download the application form here: EMPLOYER PORTAL REGISTRATION FORM

Once completed email to [email protected]

Submission of Withdrawal Claims - resignation, retirement, dismissal, retrenchment

This refers to Withdrawals (resignation, retrenchment or dismissal) and retirement claims.

The Momentum Claim Form must be completed in full and signed by both the employer and the member. A copy of the member’s ID must be submitted with the claim form and the member’s personal tax reference number must be provided. The completed application form and supporting documents must be submitted by email [email protected] or fax: 021 449 5882. For queries call: 021 940 6827.

The processing and payment of a withdrawal or retirement claim can take up to eight weeks from the member’s last active working day. This however depends on when the required documents are submitted to the Fund and on the receipt of a tax directive from the Receiver of Revenue.

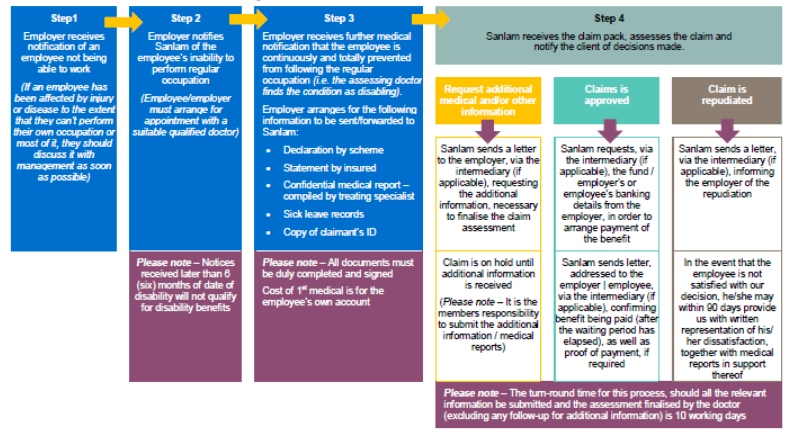

Submission of Disability Claims

This flowchart is a summary of the disability claim process, for more details click here: Sanlam Disability Claims Process 2019

Download the disability claim form here: Disability claim form

once completed email to Sanlam: [email protected]

Submission of Funeral Claims

The completed Sanlam Funeral Claim Form including the following supporting documents must be submitted to Fax: 021 449 5882 or e-mail to [email protected]

• Bank statement of spouse/claimant

• Bi 1663 form – notification of death

• Certified copy of Death Certificate

• Certified copy of member’s identity document

• Certified copy of spouse/claimants identity document

Please ensure that you have checked the claim form and that you provide ALL the required documents – this will avoid unnecessary delays in the processing of claims.

Submission of Death Claims

The Sanlam Death Benefit Claim Form must be completed in full.

A copy of the member’s ID, the death certificate and the members personal tax number must be submitted with the claim form to [email protected] or fax 021 449 5882.

The death benefit is payable in terms of Section 37C of the Pension Funds Act and a full investigation will be conducted to determine who the payments will be allocated to. A Help Desk consultant will contact the employer and the family of the deceased to obtain any additional information and documentation. All information is forwarded to the Board of Trustees for approval of the allocation of the death benefit lump sum. When tax-clearance from SARS and Trustee approval on the allocation of the death benefit lump sum have been received, the benefit is paid.